Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money.įor most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. Details correct as at 24th February 2023. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. 1 Annual saving based on re-mortgaging £205,335 from the highest big 6 lender standard variable rate at 7.49 to a 5 year fixed rate of 3.94. Compare up to three mortgages and see how the different interest rates could affect your monthly payments. Therefore, For the first-month payment: The interest you pay is: While the portion of principal paid off is: 599.55 - 500 99.

MORTGAGE INTEREST RATES CALCULATOR FULL

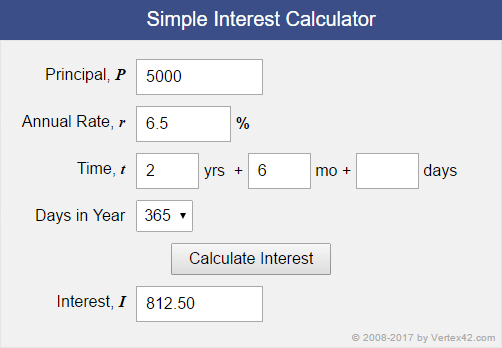

You pay the principal, with interest, back to the lender over time through mortgage payments. And it provides you with a full table of how the payments are applied to both interest cost, and principal repayments. If you use our mortgage calculator to determine how much is expected of you to pay monthly, you will find that the fixed monthly payment to cover the loan is 599.55. The 52-week high for a 30-year fixed mortgage was 7. If a mortgage is for 250,000, then the mortgage principal is 250,000. Today’s average rate on a 30-year fixed mortgage is 7.18 compared to the 7.26 average rate a week earlier. Mortgage principal is the amount of money you borrow from a lender. These autofill elements make the home loan calculator easy to use and can be updated at any point. A mortgage is high-ratio when your down payment is less than 20 of the property value. In practice, there may be differences between the timing of the loan repayments and the timing of the interest charges being added to the loan balance.Īpplications for new monies will require a minimum term of 5 years.Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. Timing of interest conversion - The calculator assumes that interest is charged to the loan account at the same frequency as the repayments are made. For example, if a mortgage rate is 6 APR, it means the borrower will have to pay 6 divided by twelve. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. The calculator assumes that the interest rate will remain the same throughout the mortgage term. Mortgage interest rates are normally expressed in Annual Percentage Rate (APR), sometimes called nominal APR or effective APR. Estimated monthly payments shown include principal, interest and (if applicable) any required mortgage insurance. Interest rate - The interest rate input is a nominal rate and is used to calculate the total interest payable over the mortgage term. Eastern Daylight Time and assume borrower has excellent credit (including a credit score of 740 or higher). For example, let’s say that John wants to purchase a house that costs 125,000 and. R stands for the monthly interest rate for your loan. T stands for the term of your loan in months. Rounding of repayment amounts - The calculator uses the unrounded repayment to derive the amount of interest payable over the full term of the loan. The basic formula for calculating your mortgage costs: P A R (1 + R)T/ (1 + R)T 1 P stands for your monthly payment. Monthly repayments – The calculator divides the mortgage amount and the total interest payable by the total number months in the mortgage term. Please ensure you obtain a personalised Mortgage Illustration before making a decision to proceed with a mortgage. Our Rate Change Calculator will give you an idea of how much your monthly mortgage payment might change by.

to how low your interest rate can be if youre on a Nationwide tracker mortgage. The mortgage calculator can help you to estimate the amount you can borrow.

The figures provided by this calculator are for information purposes only. Our mortgage repayments calculator can help you find out how much your. Calculate your maximum mortgage in the Netherlands.

0 kommentar(er)

0 kommentar(er)